Overview

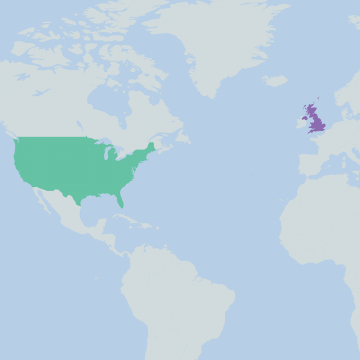

AlgoSpan, a UK-based specialist market infrastructure provider, completed its sale to Pico, a US based group of affiliated managed services providers of multi-asset electronic trading technologies. Financial terms of the transaction were not disclosed.

Significance

The acquisition of AlgoSpan allows Pico to broaden its European expansion, with increased infrastructure, connectivity and market data solutions among new capabilities.

Launched in 2010, AlgoSpan is based in the UK and provides end-to-end trading infrastructure and real-time market data services to financial firms operating low latency trading strategies.

Founded in 2009, Pico is a financial technology managed services firm and an agency-only broker dealer providing its products and services to a client base encompassing the full spectrum of market participants (including proprietary trading groups, market makers, asset managers, banks, broker dealers, hedge funds, technology vendors and liquidity venues).

Pico provides infrastructure, integration management, and software solutions. It has created a growing ecosystem of trading applications, market data, and analytic software providers within its hosted environment. It also processes a significant amount of real-time order and execution data for its brokerage business and has developed solutions for risk management and regulatory reporting in the US.

Our Role

NovitasFTCL was sole adviser to all shareholders of AlgoSpan (including management and AlgoEngineering Europe), ending up in the acquisition of 100% of the firm by Pico.