Centaur has agreed to acquire an existing administration firm, Luxembourg Capital Partners S.A., which currently provides a full suite of fund administration services to funds, family offices and corporate vehicles. The transaction is subject to the approval of the Luxembourg regulator, the CSSF.

Luxembourg is a key strategic location for Centaur and will act as an important servicing office, primarily for Private Equity (PE) and Real Estate (RE) funds and related investment vehicles. Located in the heart of Europe, Luxembourg provides a favourable legal regime to PE/RE firms. For over 20 years, it has become a central hub for the PE/RE industry and continues to attract an increasing number of PE/RE firms. In fact, Luxembourg is now home to the world’s top 13 PE firms

The acquisition, along with a planned expansion of Centaur’s Luxembourg base, are key steps in Centaur’s strategy to becoming a leading player in PE/RE administration. Karen Malone, Founding Partner of Centaur explains:

“Luxembourg represents a key strategic location for Centaur. Not only will it enhance our global reputation, it will also enable us to build and service our PE and RE clients. This office, backed by our existing global network, will enable PE and RE clients to benefit from an international team that is the most experienced in the industry”.

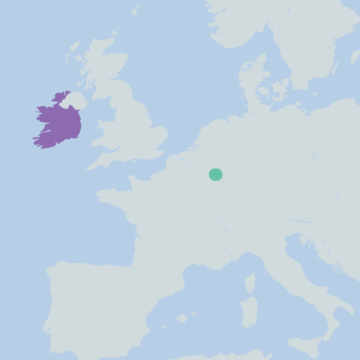

Transaction Map

Counterparty

Client